A Century in the City, 1887-1987 | Part I | Part 2

Brochure celebrating Chase Manhattan's first 100 years in London

Thank you to Allan Wright, former chief teller at the London bank at Berkeley Square, for providing the brochure. Due to limits to image resolution on our website, we have provided the text separately. In order to maintain the layout, we recommend looking at this on a desktop or laptop (not on a tablet or phone). No credits were given in the brochure, so we do not know its author or original designer.

The Setting

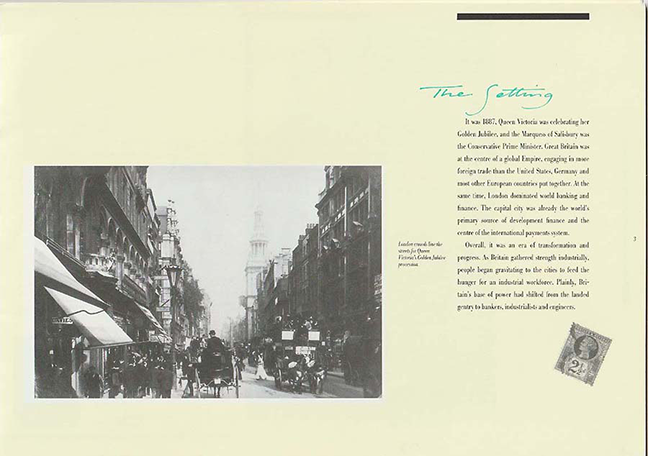

It was 1887. Queen Victoria was celebrating her Golden Jubilee and the Marquess of Salisbury was the Conservative Prime Minister. Great Britain was at the centre of a global Empire, engaging in more foreign trade than the United States, Germany and most other European countries put together. Ar the same time, London dominated world banking and finance. The capital city was already the world's primary source of development finance and the centre of the international payments system.

Overall, it was an era of transformation and progress. As Britain gathered strength industrially, people began gravitating to the cities to feed the hunger for an industrial workforce. Plainly, Britain's base of power had shifted from the landed gentry to bankers, industrialists and engineers.

Caption: London crowds line the streets for Queen Victoria's Golden Jubilee procession.

American Entrepreneurs

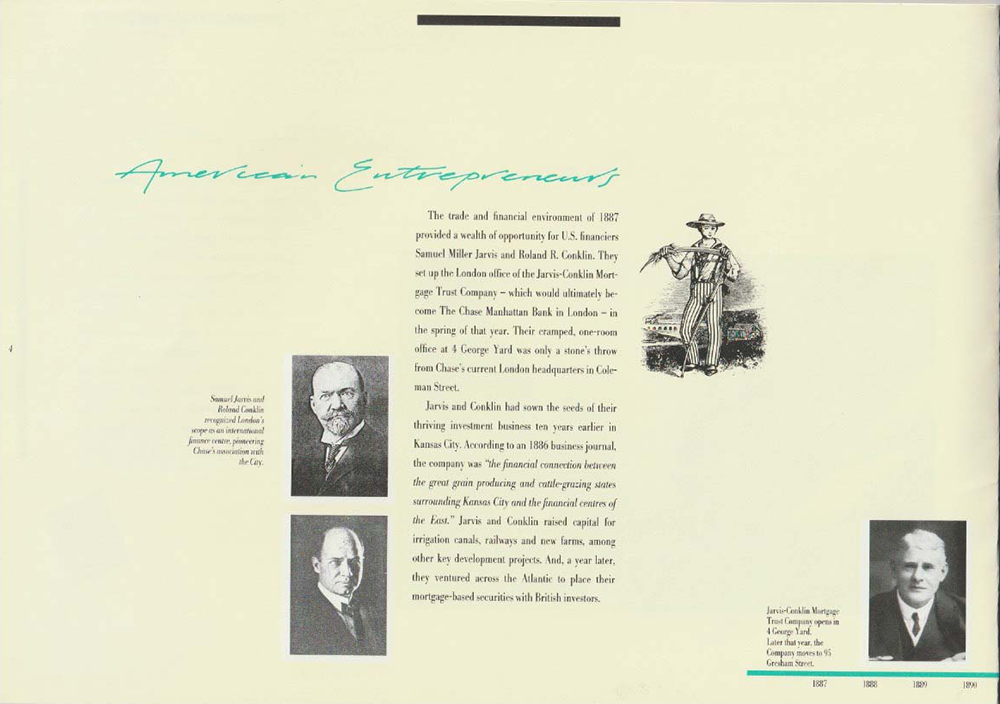

The trade and financial environment of 1887 provided a wealth of opporunity for U.S. financiers Samuel Miller Jarvis and Roland R. Conklin (Photos, left). They set up the London office of the Jarvis-Conklin Mortgage Trust Company – which would ultimately become The Chase Manhattan Bank in London – in the spring of that year. Their cramped, one-room office at 4 George Yard was only a stone's throw from Chase's current London headquarters in Coleman Street. (Later in 1887 the Company moved to 95 Gresham Street.)

Jarvis and Conklin had sown the seeds of their thriving investment business ten years earlier in Kansas City. According to an 1886 business journal, the company was "the financial connection between the great grain producing and cattle-grazing states surrounding Kansas City and the financial centres of the East." Jarvis and Conklin raised capital for irrigation canals, railways and new farms, among other key development projects. And a year later, they ventured across the Atlantic to place their mortgage-based securities with British investors.

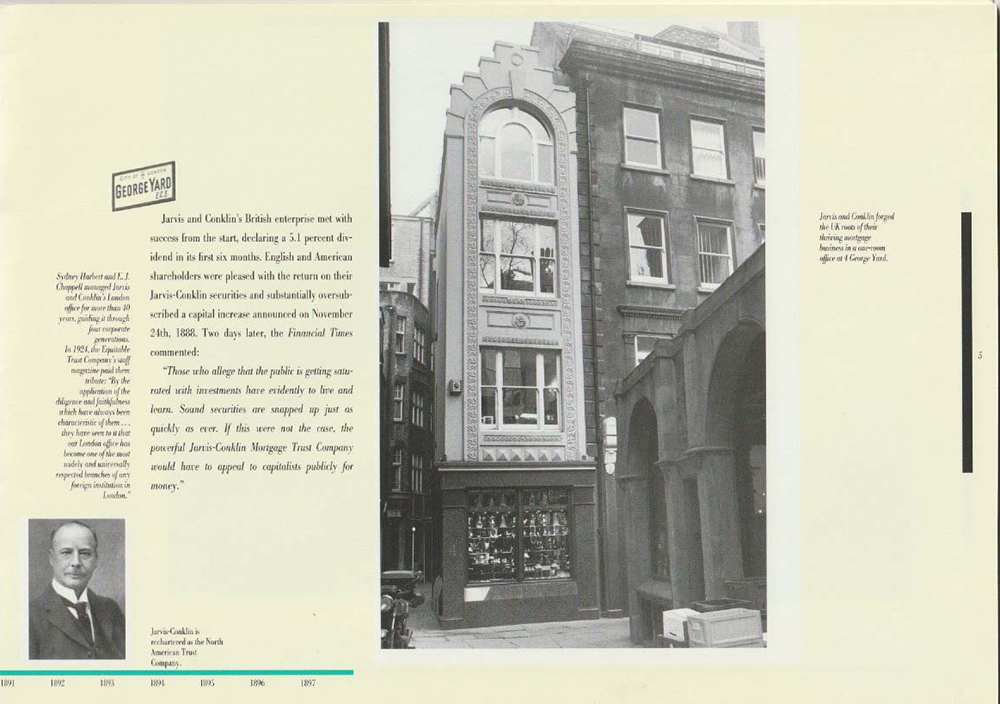

Jarvis and Conklin's British enterprise met with success from the start, declaring a 5.1 percent dividend in its first six months. English and American shareholders were pleased with the return on their Jarvis-Conklin securities and substantially oversubscribed a capital increase announced on November 24th, 1888. Two days later, the Financial Times commented: "Those who allege that the public is getting saturated with investments have evidently to live and learn. Sound securities are snapped up here as quickly as ever. If this were not the case, the powerful Jarvis-Conklin Mortgage Company would have to appeal to capitalists publicly for money."

Jarvis and Conklin's British enterprise met with success from the start, declaring a 5.1 percent dividend in its first six months. English and American shareholders were pleased with the return on their Jarvis-Conklin securities and substantially oversubscribed a capital increase announced on November 24th, 1888. Two days later, the Financial Times commented: "Those who allege that the public is getting saturated with investments have evidently to live and learn. Sound securities are snapped up here as quickly as ever. If this were not the case, the powerful Jarvis-Conklin Mortgage Company would have to appeal to capitalists publicly for money."

Left caption: Sydney Harbert and E.J. Chappell managed Jarvis and Conklin's London office for more than 40 years, guiding it through four corporate generations. In 1924, the Equitable Trust Company's staff magazine paid them tribute: "By the application of the diligence and faithfulness which have always been characteristic of them...they have seen to it that our London office has become one of the most widely and universally respected branches of any foreign institution in London."

Mergers for a New Financial Era

Unfortunately, Jarvis-Conklin's initial U.K. success was shortlived. In 1893, a national stock-market crisis in the U.S. made the business unprofitable and left angry stockholders calling for action. To resolve the situation, Jarvis and Conklin dissolved the original company and reconstituted it under the charter of the North American Trust Company. The North American Trust Company maintained the original London office to make payments to British shareholders during the liquidation of Jarvis-Conklin assets in the U.S.

Eventually, Jarvis and Conklin bowed out of London completely, selling their interest in the company and moving to Cuba to develop its National Bank.

The departure of Jarvis and Conklin and the appointment of Colonel Dowd to the North American Trust Company's New York office in 1899 signalled a new era for the company.

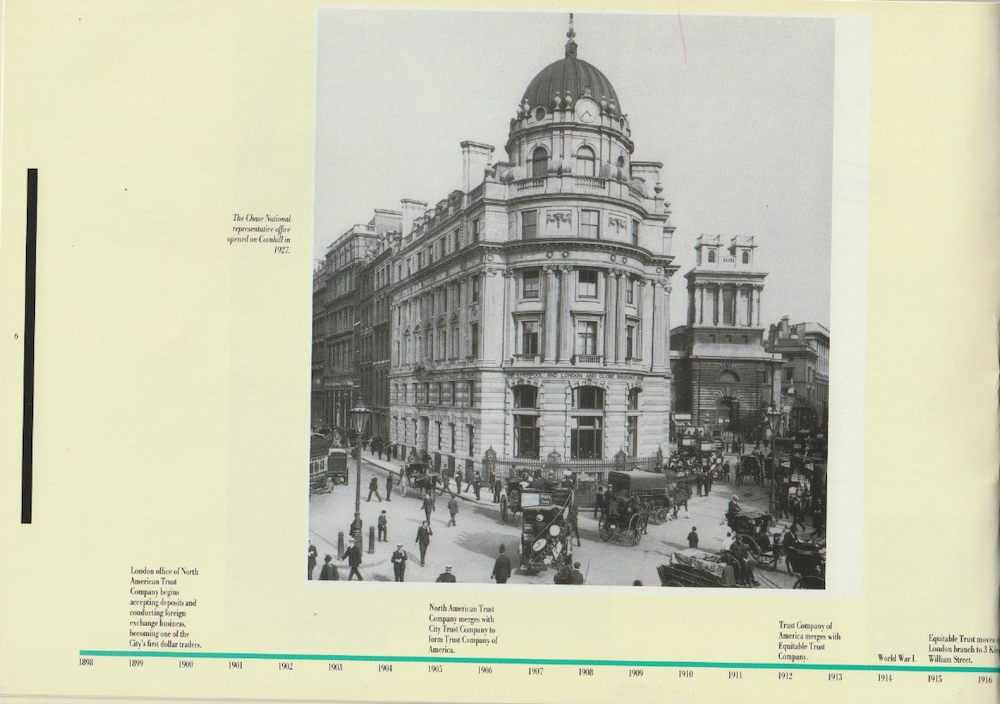

The London office began taking deposits and conducting foreign exchange business under Dowd's direction, making it one of the first institutions to engage in dollar trading in London. From the New York office, Dowd applied a policy of "conservative progressiveness" that continued after the North American Trust Company became the Trust Company of America in 1905 and remained valid until The Equitable Trust Company of New York bought the firm in 1912.

By the mid twenties, The Equitable Trust Company had 117 employees

and had grown beyond its international banking and foreign exchange

roots. By 1924, Equitable Trust's London office boasted £11,000,000 in

deposits, 1700 accounts and a wide range of commercial and investment

banking services, including bill collection and discounting, commercial

credits, foreign exchange and stock exchange transactions.

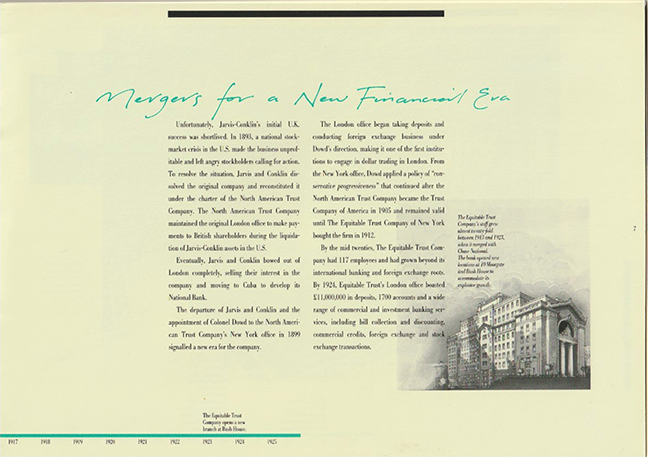

Caption above right: The Equitable Trust Company's staff grew almost twenty-fold between 1913 and 1923, when it merged with Chase National.

The bank opened new locations at 10 Moorgate and Bush House to accommodate its explosive growth.

Change forges ahead

Change forges ahead

After World War I, London's financial outlook was strong and Equitable Trust made the most of it, expanding its corporate and private client services. Its merger with The Chase National Bank several years later was a logical extension of the existing development strategy.

By June 1930, the bank had established the Chase National Executors and Trustees Corporation Limited to conduct trust business. For private clients, Chase National provided current accounts, issued travellers' cheques, dealt in securities and provided vaults for valuables. Corporate clients turned to the bank for trade finance, bills of exchange and commercial letters of credit.

But more significantly, the bank began cultivating a new client base that would ultimately become its most important. Under the direction of John Wallace, vice president, the former head of foreign exchange, Chase National began marketing to U.S. corporate clients operating in London, offering support for their businesses in Britain and continental Europe.

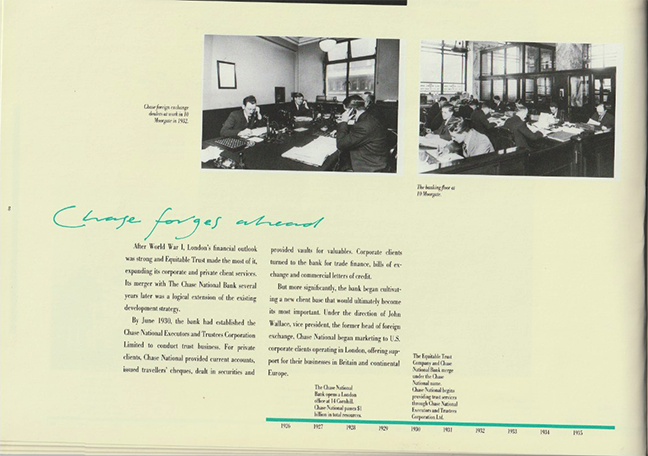

Caption top left: Chase foreign exchange dealers at work at 10 Moorgate in 1932.

Caption top right: The banking floor at 10 Moorgate.

Timeline:

1927: The Chase National Bank opens a London office at 14 Cornhill. Chase National passes $1 billion in total resources.

1930: The Equitable Trust Company and Chase National Bank merge under the Chase National name. Chase National begins providing trust services through the Chase National Executors and Trustees Corproation Ltd.

Caption below: The elegant marbled banking hall at 10 Moorgate reflected the success of the bank's operations in the early 1930s.