This is a periodic column by CAA Board Member Dan Alvarez, addressing technology issues in the banking world, for non-tech professionals.

#11 AI Agents PART ONE

(November 2025)

AI Agents: Your Future Digital Coworkers

(And Why They Won't Steal Your Lunch)

Welcome back! If you've been following the news lately, you've probably heard the term "AI agents" tossed around like confetti at a New Year's party. But what exactly are AI agents, and why is JPMorganChase betting billions that they're the future of banking? In this issue, we're breaking down this technology in plain English – no computer science degree required, we promise.

The reason this matters to all of us alumni: JPMC is currently undergoing what Chief Analytics Officer Derek Waldron calls a "fundamental rewiring" to become a fully AI-connected enterprise. In fact, about 250,000 JPMC employees already have access to the bank's AI platform, LLM Suite, with over half using it daily. So whether you're still at the firm or just curious about where the finance industry is heading, understanding AI agents and their impact over the next several years is critical.

What exactly IS an AI agent?

Think of an AI agent as a digital assistant that can actually do things, not just answer questions.

You know how Siri or Alexa can tell you the weather or set a timer? That would be a basic use case for AI. However, an AI agent can understand complex requests, break them down into steps, use multiple tools and applications, make decisions along the way and complete entire tasks with minimal hand-holding.

For example, instead of just answering "What's our Q3 revenue?", an AI agent could pull the data from five different systems, create charts, compare it to projections, identify trends and generate a presentation – all from a single request. It's less "assistant" and more "digital co-worker who never needs coffee breaks."

How is an AI agent different from the chatbots I've been seeing everywhere?

The key word is "agentic" – meaning it has agency, or the ability to act independently.

Traditional chatbots are reactive. You ask, they respond…many of them are fancy FAQ machines. AI agents are proactive and autonomous. They can:

- Plan multi-step workflows

- Make decisions based on context

- Use tools and access systems on your behalf

- Learn from feedback and adjust their approach

- Handle tasks that would normally require back-and-forth human intervention

It's the difference between a vending machine (chatbot) and a personal chef (AI agent). One gives you what you ask for directly; the other can figure out what you need and make it happen using all the tools it has available at its disposal.

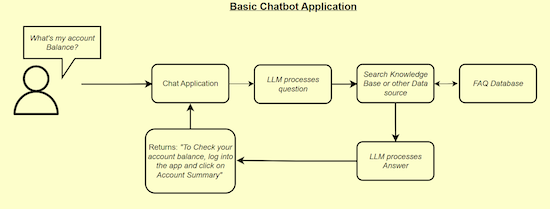

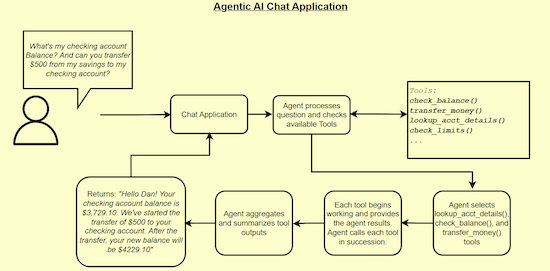

Here is a sample flow of a basic chatbot compared to an agentic chatbot:

What kinds of things can Agentic AI do for JPMorganChase?

Here's one straight from JPMC's playbook.

Recently, Derek Waldron demonstrated the bank's LLM Suite by asking it to create a five-page investment banking presentation for a meeting with Nvidia's CEO and CFO, including the latest news, earnings and peer comparisons. The agent delivered a complete, credible PowerPoint deck in about 30 seconds.

In the past, this task would've most likely required a team of junior bankers working late into the night. The agent searched for current information, pulled financial data, created visualizations, formatted slides and structured the narrative – all autonomously.

Please make no mistake – after creating something like this, it will go through a round of scrutiny from those analysts. This is called “human in the loop” and it’s a fundamental part of using AI in any use case. AI-anything does make mistakes, sometimes quite often, so it’s essential to keep humans in the loop to verify, provide feedback and issue corrections before things become finalized.

Other examples JPMC is exploring:

- Fraud detection agents that monitor transactions and flag suspicious activity in real-time

- Customer service agents that can resolve complex account issues without human intervention

- Research agents that can analyze market conditions and generate investment insights.

What makes AI agents "intelligent"? Are they actually thinking?

Not really – but they're really good at faking it. AI agents are powered by Large Language Models (LLMs) – the same technology behind ChatGPT (check out our Tech Corner #2 article on Generative AI to learn more). These models have been trained on vast amounts of text data, allowing them to understand context, generate human-like responses, and even reason through problems.

Here’s a summary on what they’re doing behind the scenes: They're not conscious or truly "thinking." They're incredibly sophisticated pattern-matching machines. They predict the most likely next action or response based on patterns they've learned. It's like having someone who has read every book in the library and can instantly recall and synthesize relevant information – but doesn't actually understand it the way humans do.

The "agent" part comes from wrapping these models with the ability to use tools, access data and take actions. Think of the LLM as the brain, and the agent architecture as the body that lets it interact with the world.

What kinds of investments is JPMorganChase making into agentic AI?

JPMC is going all-in on AI agents – we're talking about an $18 billion annual tech budget kind of commitment.

The bank's LLM Suite platform currently uses models from OpenAI and Anthropic, and is updated every eight weeks as they feed it more data from their vast databases and software applications. Here's what's happening across the firm according to a recent case study by AIX:

Currently deployed:

- LLM Suite: Available to ~250,000 employees (everyone except branch and call center staff) for drafting emails, summarizing documents, and research purposes

- Coach AI at J.P. Morgan: A real-time advisory tool that helps J.P. Morgan wealth managers.access research and investment recommendations, which helped improve response times by 95 percent during market volatility

- AI coding assistants: Helping developers work 10-20 percent faster by automating redundant coding tasks.

In development:

- J.P. Morgan investment banking document creation (like those thick confidential memos for M&A deals)

- Customer-facing AI at Chase branches and call centers that can interact directly with retail banking clients

- Automated compliance and risk management processes.

As Waldron puts it, the vision is that "every employee will have their own personalized AI assistant; every process is powered by AI agents, and every client experience has an AI concierge.

What's the actual business value? How expensive is something like this?

Depending on the use case, scale and complexity, it can be expensive. But the potential returns are massive.

JPMC's asset and wealth management division saw a 20 percent increase in gross sales from 2023 to 2024, partly attributable to AI-driven tools. The Bank also estimates that AI will help advisors expand their client rosters by 50 percent over the next three to five years.

The value comes from three main buckets:

- Productivity gains: Tasks that took hours now take minutes. More work gets done with the same (or fewer) people.

- Better decision-making: AI agents can analyze more data faster than humans, spotting patterns and opportunities we might miss.

- Competitive advantage: If JPMC can beat other banks to incorporate AI fully, it will enjoy higher margins through its first-mover advantage before the rest of the industry catches up and can capture more market share globally.

The Bank has openly stated they have "a very strong bias against having the reflexive response to any given need to hire more people." Translation: AI is directly impacting workforce planning.

_____________________________________________________________________________

Links to Prior CAA Tech Corner Columns

#1 Artificial Intelligence

#2 Generative AI

#3 Autonomous Cars

#4 Anatomy of a Modern Credit Card

#5 How to Whitelist an Email Address

#6 Multi-Factor Authentification

#7 The Science of a $100 Bill

#8 The CrowdStrike Disaster

#9 JPMC Meets Amazon in the Cloud

#10 Mobile Payments/Digital Wallets